Young Innovative Enterprise and research tax credit : the accumulated tax savings

Young Innovative Enterprise and Research Tax Credit (CIR) – Abstract

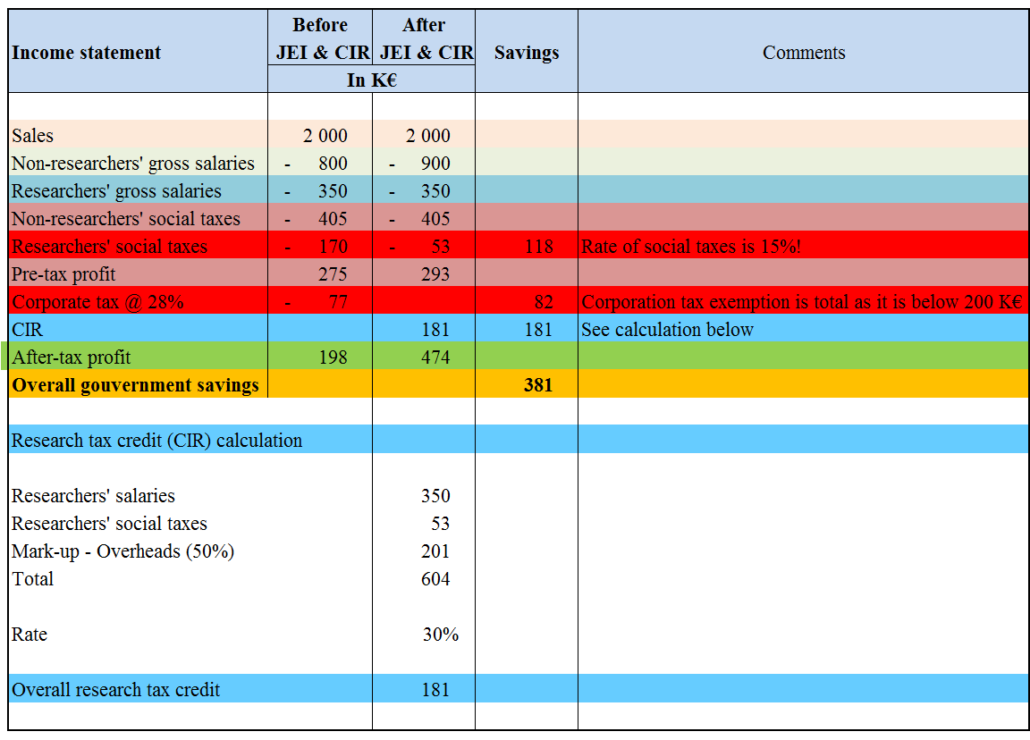

The Young Innovative Enterprise Enterprise is a status that the subsidiary of a foreign company can accumulate with the research tax credit under certain conditions. See the example below.

An example of savings Young Innovative Enterprise status and CIR

The data

M, which has no other subsidiary than F, has declared for the fiscal year closed on December 31, 2022, a (euro equivalent) 35 M€ turnover, with 120 employees. F declared a 2 M€ turnover, with 23 employees, 1.25 M€ of gross salaries, of which 0.35 M€ of personnel costs for research operations, social taxes (@ 42% before any exemptions) and a 0.083 M€ of corporate tax. The company did not file for either the CIR or the JEI status at the end of 2021. What grant aid can the company still benefit from for the 2022 calendar year? If possible, how much can the aid be?

The answers

1) F can still benefit from the JEI status until the 31st of December 2024 because,

- The company filed the JEI before it being acquired by M,

- It is an SME under the European definition (the parent company and the subsidiary company employ together less than 250 people),

- It is over 50% owned by physical persons and venture capital funds,

- R&D expenses represent 843 K€ (405+158 x 1,50), which is far above the threshold of 15% of the total charges.

2) It can also benefit from the research tax credit (CIR over the year 2022 as well).

3) it can get a corporation tax exemption, provided

- the corporation tax expense does not exceed 200 K€

- this is the first time the company records a pre-tax profit.

3) All in all it can save K€ 381 !!

Young Innovative Enterprise