Green industry tax credit (C3IV) : how to benefit?

Green industry tax credit (C3IV) – Abstract –

The green industry tax credit (in French Crédit d’Impôt au titre des investissments pour une industrie verte – C3IV) is designed to support investment in the production of clean technologies. It can be worth up to €150 million, or even more in some cases. Below is a summary of the scheme.

Which companies are eligible for the green industry tax credit?

Industrial and commercial companies, taxed according to a real system or temporarily exempted, are eligible for this green investment tax credit, subject to prior approval.

They must, among other things,

- Not to be in difficulty according to European Union regulations,

- Commit to operating eligible assets for 5 years (large companies), 3 years (others).

What expenses are eligible?

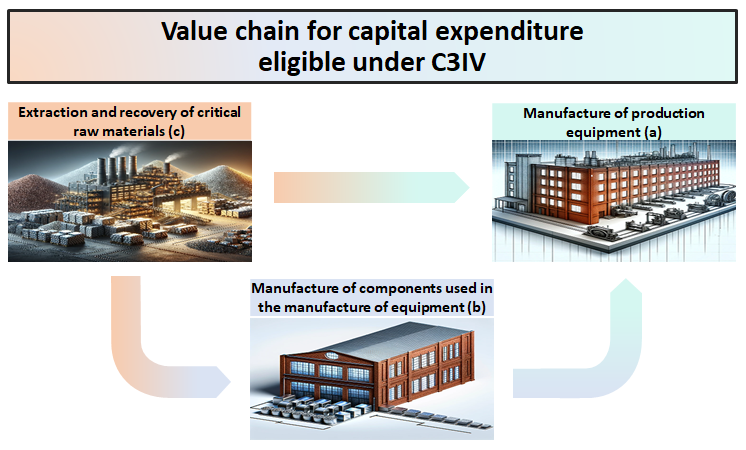

Investments eligible for the green industry tax credit are

- not only those used to manufacture batteries, solar panels, wind turbines and heat pumps,

- but also those that enable

- manufacture the components essential to the production of this equipment and machinery and/or

- add value to the critical raw materials used in the manufacture of the above-mentioned components, equipment and machines.

These suppliers must, however, generate at least 50% of their sales with companies downstream of the production chain.

The following diagram summarizes the value chain.

C3IV

These include capital expenditure incurred for

- The acquisition of assets from unrelated companies

- Property, plant and equipment (buildings, installations, equipment, machinery and land needed to operate the equipment) and

- Intangible assets (patents, licenses, know-how or other intellectual property rights),

- The acquisition of temporary occupation permits for plots of land on which the production facilities will be built.

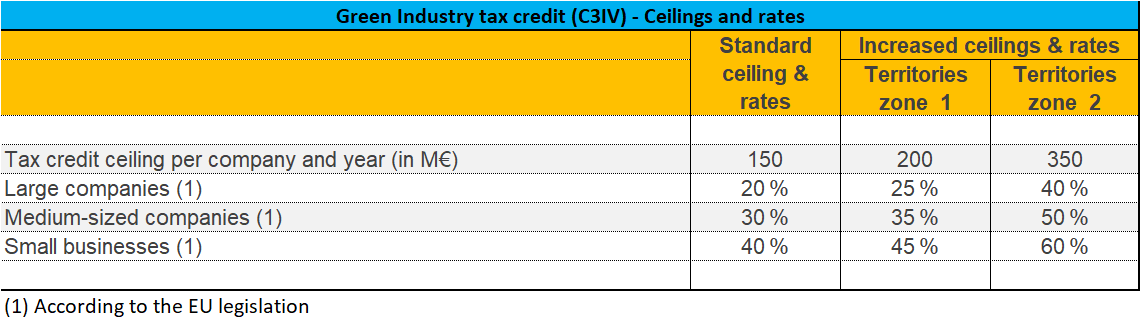

What ceilings and rates apply

In principle, the green industry tax credit cannot exceed €150 million. The standard rate is 20% for large companies, 30% for SMEs and 40% for VSEs (as defined by the EU).

By way of exception, these ceilings and rates are increased respectively by

50 million and by 5 points for investments in regional development zones in mainland France,

Green investment tax credit

Approval process

To qualify for the green industry tax credit (C3IV) scheme, a request for approval must be submitted jointly by the tax authorities (DGE+ DGFIP) and ADEME (The French Agency for Ecological Transition) before building work begins.

Only expenses incurred after approval are eligible for the tax credit. Approval will be granted until December 31, 2025.

Reimbursement and accumulation with other schemes

The tax credit is deducted from the corporation tax. The excess is reimbursed immediately.

It can be combined with other innovation grants (CIR, Young Innovative Status (JEI), CII).