Collaborative Tax Credit (CICO) : how to take advantage of it?

Collaborative Tax Credit (CICO) : How can a foreign company benefit from it?

Abstract

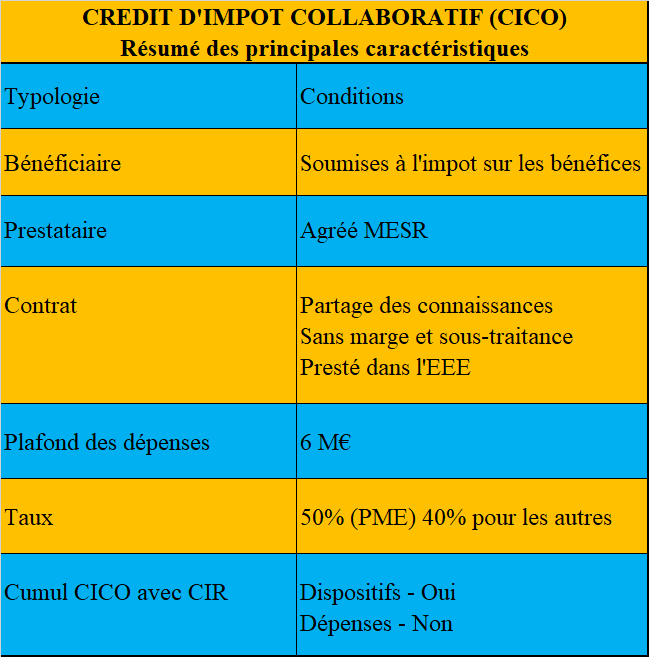

The 2022 Tax Law enacted the Collaborative Tax Credit as of January 1, 2022, to compensate for the elimination of the doubling of expenses of chartered research organizations in the calculation of the Research Tax Credit ( Crédit d’Impôt Recherche (CIR)). While many provisions are common to both the CIR and the CICO, there are some differences. Here are some explanations.

Purpose of the collaborative tax credit

It is to encourage the sharing of costs, risks and benefits on a project. It is based on a collaboration contract and not on a subcontracting project, which in return for the invoicing of a commercial margin, forbids the provider to use the acquired knowledge.

Which companies can benefit from the Collaborative Tax Credit?

All companies subject to corporate income tax in France. This definition is strictly identical to that of the recipients of the CIR. Hence, liaison offices, and branches of foreign companies not identified for tax purposes in France are excluded.

What types of contracts are eligible for the Collaborative Tax Credit?

The contract must be concluded

o Between January 1, 2022 and December 31, 2025, with an organization chartered by the Ministry of Research and Higher Education,

o Prior to the execution of the work,

o Allow for risk sharing and publication of the results obtained, which proscribes the possibility of the beneficiary being the sole owner of the work.

The work must be performed in the European Economic Area (AAE), directly by the research organization at cost price and not exceed 90% of the total expenses incurred.

What are the maximum rates and basis?

The CICO rate is 50% for companies that meet the definition of European SMEs, and 40% for others, for a maximum expenditure of €6 million. The CICO is therefore capped at €3M for SMEs and €2.4M for other companies.

How is the CICO reimbursed?

Like the Crédit d’Impôt Recherche (CIR)), the CICO can be deducted from the corporate income tax related to the current year. The surplus is

– Immediately refundable for European SMEs,

– Can be returned after 3 years if not applied to corporate income tax.

Can the CICO be accumulated with the research tax credit (Crédit d’impôt Recherche (CIR))?

A company can benefit in principle from the CICO and the CIR. However, the same expenses cannot be eligible for both the CICO and the CIR. Since the reimbursement rate for the CICO is higher (40%) than that of the CIR (30%), the former should be favored over the latter.

How do I know if the expenses invoiced by research organizations are eligible for the CICO?

Like the CIR, you can file a prior notice request with the tax authorities.

To sum up, the CICO