Manager in France: what are your responsibilities?

On the verge of being appointed as manager in France, what are your responsibilities according to French commercial and labor law? To begin with, it is key to know your official title.

Manager in France and responsibilities; what is your official title?

If the subsidiary is an SAS:

According to French commercial law, legal representatives of an SAS are primarily the president or by delegation of power the managing directors. Members of the board can also be representatives but this is only optional in an SAS (because the board in this case can only be created by company by-laws).

Moreover, the manager can be the permanent representative of the company if the foreign group is appointed as the legal representative of the subsidiary.

The position of the permanent representative is acquired from the moment the legal representative is registered at the Registre National des Entreprises (Which replaces as from 01/01/2023: the RNE contains every head of company based in France).

The president of the SAS has an extensive authority that cannot be reduced. On the other hand, the responsibilities of managing directors or legal representatives are founded by company by-laws.

If the subsidiary is an SARL:

Legal representatives of an SARL can only be a person.

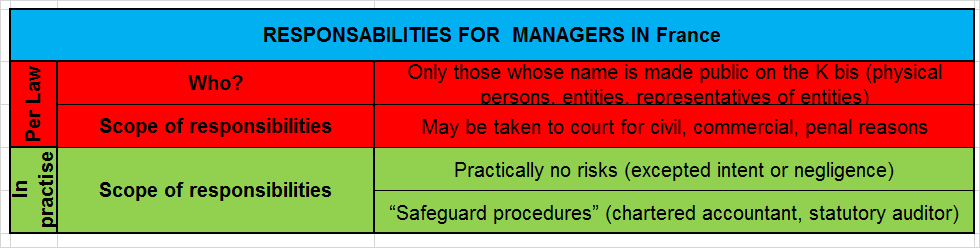

What are your liabilities as a manager in France?

From the civil point of view…

Legal representatives are liable for legal and regulatory infractions of the violation of the company by-laws and management misdemeanor. But in practice these legal cases are rare.

And from the criminal point of view

French commercial law provides specific sanctions for SARL managers. But they are only applied in the case of malicious intent. At this level, the statutory auditor would warn the manager before any action of the court.

Below is a summary of your responsibilities as a manager in France – Per law and in practice.

The Jean-Claude ARMAND and Associates firm assists you in the selection of the most suitable choice of legal status when creating a subsidiary in France.