branch with no tax identification or liaison office : how to choose?

Branch with no tax identification: Have you ever considered this solution rather than the liaison office when starting a business in France? Because if both these organizations are fit just for hiring one or two staff(s) aimed at collecting information on potential clients, the branch with no tax identification allows to open a bank account…

Creating a liaison office…

To achieve this objective, the company needs to simply get a SIRET Number, which allows you to be identified towards all French social bodies. The main advantage is that the process of creation is easier than in the second option. The main drawback is that the company is cannot have a bank account in France. Hence, all social taxes have to be paid using the company’s bank account located in the country of origin. However, all withdrawals to pay all social and withholding taxes are automated when the foreign companies use a SEPA bank account.

…Or a branch with no tax identification

A second option consists in creating a branch with no tax identification towards the tax administration. This means the company does not to file neither a corporate tax nor VAT returns in France.

Unlike the first option, the company is identified in France towards not only social bodies but also all other third parties. This situation allows – in principle – the branch to open a bank account in France. This entails 4 advantages. First, payroll provider will trigger the payment of all social expenses on the company’s behalf regardless. Second, the company can open accounts at utilities (such Internet providers, cells phones) to directly pay these expenses incurred by employees in France. Third, the company can strike a lease agreement in France. This may be key if all staffs need to work in the same location to be efficient. Finally, being identified towards potential clients allows to strike deals with them more easily. Very large accounts and public ones require a bank account in France to pay vendors’ invoices.

This second option has 3 drawbacks. First, processing the creation is heavier. The foreign company needs (ii) to have an official address at a registered office (consider 1 200 € per annum) and (iii) to open a bank account in France (consider 800 € per annum)

How to choose between the liaison office and the branch with no tax identification?

The first option will suffice if employees collect inform information and can work from home.

This second option is recommended if (i) company’s clients do not require either a commercial identification to strike deals and/or(i) a French bank account to pay invoices.

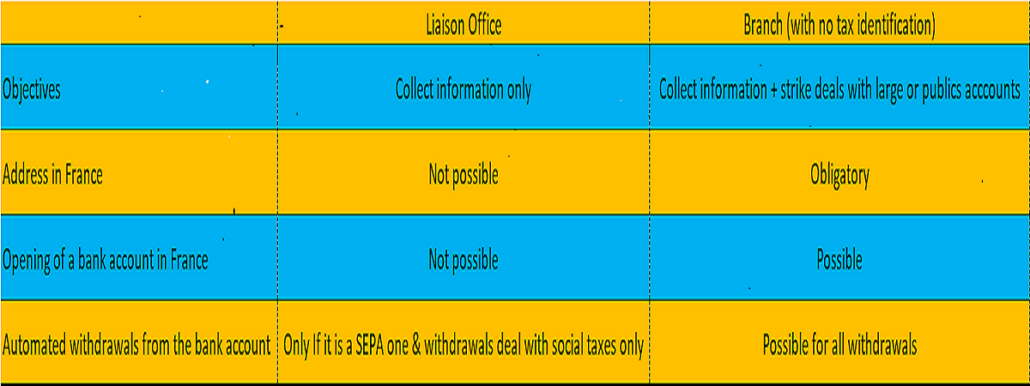

Summary

The aforementioned writings can be summed up as follows:

Branch with no activity

Jean-Claude ARMAND and Partners advices you to choose the establishment structure in France (liaison office, branch, subsidiary company).

Need more information?